What is AoraBooks?

AoraBooks is an advanced Online Accounting Software designed to revolutionize the way businesses handle their inventory, finances, and overall operations. It serves as an all-encompassing solution, offering a comprehensive suite of features that span key aspects of business management, including but not limited to invoicing, accounting, receivables, payables, payments, expenses, mobile accessibility, point of sale (POS), multi-company and multi-branch support, inventory management, banking, contacts, HR integration, GST and VAT compliance, Reporting and bank reconciliation, and multi-currency support.

Why AoraBooks?

Comprehensive Functionality:

AoraBooks provides a one-stop solution that integrates various functions critical to business operations. This comprehensive approach eliminates the need for multiple disjointed systems, ensuring a cohesive and streamlined management platform.

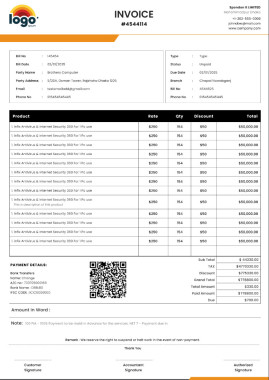

Advanced Invoicing and Accounting:

AoraBooks offers an advanced invoicing system and a robust accounting module, empowering businesses to create professional invoices, track financial transactions accurately, and maintain transparent and up-to-date financial records.

Efficient Financial Management:

The platform excels in managing receivables, payables, and overall cash flow. It streamlines payment processing, facilitates expense tracking, and ensures efficient banking transactions, contributing to enhanced financial control and operational efficiency.

Operational Flexibility with Mobile Accessibility:

Recognizing the importance of mobility in modern business, AoraBooks provides a mobile-friendly interface. This feature allows users to manage inventory and finances on-the-go, providing unparalleled flexibility and accessibility to business operations.

Integrated Point of Sale (POS):

AoraBooks seamlessly integrates a Point of Sale system, enabling businesses to conduct sales directly within the inventory management system. This simplifies transactions and ensures real-time synchronization of sales data with overall financial records.

ZATCA:

Aorabook's integration with the Zakat, Tax, and Customs Authority (ZATCA) in Saudi Arabia is a pivotal feature that underscores the software's commitment to providing a comprehensive and compliant accounting solution. ZATCA, formerly known as GAZT, is the principal regulatory body overseeing customs and various taxes in Saudi Arabia. Aorabook's dedicated ZATCA module is designed to streamline and enhance the interaction between businesses and the regulatory authority, ensuring seamless compliance and efficient tax management.

One of the key functionalities of Aorabook ZATCA is its ability to seamlessly connect with the ZATCA portal, offering users a direct interface for a range of essential services. This integration empowers businesses by simplifying processes such as taxpayer registration, filing returns, tax payments, and the retrieval of important documents related to these transactions. Users can navigate the ZATCA portal effortlessly through the Aorabook platform.

Aorabook's integration with ZATCA stands as a testament to its commitment to providing businesses in Saudi Arabia with a powerful and compliant accounting solution. By incorporating features tailored to the specific requirements of ZATCA, Aorabook ensures that businesses can navigate the complexities of tax and customs regulations with ease, contributing to the overall efficiency and success of their financial operations.

Adaptability to Business Structure:

AoraBooks is designed to cater to businesses of varying sizes and structures. With support for multi-company and multi-branch operations, the platform provides adaptability to the diverse organizational needs of modern enterprises.

Precision in Inventory Management:

AoraBooks offers real-time visibility into stock levels, optimizing inventory management. This ensures businesses can prevent stockouts, minimize overstock situations, and maintain an efficient and cost-effective supply chain.

Efficient Contact and HR Management:

The platform centralizes contact management, making it easy for businesses to maintain accurate and updated information about customers, suppliers, and other stakeholders. Additionally, AoraBooks integrates human resources features, facilitating seamless employee information management.

TAX Compliance with GST and VAT:

AoraBooks assists businesses in adhering to TAX regulations with built-in features for GST and VAT compliance. This ensures businesses operate within legal bounds, reducing the risk of penalties and legal complications.

Strategic Insights and Reporting:

AoraBooks generates in-depth insights and reports, providing businesses with valuable data for informed decision-making. This feature is instrumental in shaping strategic plans, adapting to market dynamics, and maintaining a competitive edge.

Global Business Support with Multi-Currency:

Recognizing the global nature of business, AoraBooks supports multiple currencies. This facilitates international transactions, allowing businesses to operate on a global scale with ease.

How AoraBooks?

AoraBooks achieves its goals through a combination of innovative features, cutting-edge technology, and user-friendly interfaces. The platform employs intuitive design principles, ensuring that users can navigate and leverage its functionalities with ease. By integrating automation, real-time data processing, and a focus on customization, AoraBooks simplifies complex business processes and provides a seamless experience for users.

In essence, AoraBooks stands out as a versatile and forward-thinking solution, offering businesses the tools they need to thrive in today's competitive landscape. Its feature-rich platform, commitment to efficiency, and adaptability make AoraBooks a strategic asset for businesses aiming to enhance operational efficiency, achieve financial control, and foster sustained success.

AoraBooks: Elevating Business Operations through Advanced Accounting and Inventory Management.

In the ever-evolving landscape of business management, AoraBooks emerges as a game-changer, set to redefine the standards of inventory management and financial control. With a visionary approach, AoraBooks is positioned to become the preeminent Inventory Management Software System, offering a robust suite of features designed to streamline operations and enhance overall efficiency. At its core, AoraBooks places a significant emphasis on the importance of its accounting system, recognizing it as the linchpin for businesses seeking seamless and effective operational control.

Key Features of AoraBooks:

Invoicing Excellence: AoraBooks simplifies and enhances the invoicing process, providing businesses with a tool to create, customize, and manage invoices effortlessly. This feature is instrumental in maintaining a steady cash flow, ensuring timely payments, and fostering positive client relationships.

Advanced Accounting Module: The backbone of AoraBooks lies in its advanced accounting module. This feature empowers businesses to maintain accurate financial records, track transactions, and generate comprehensive financial reports. A robust accounting system is crucial for informed decision-making and regulatory compliance.

Efficient Receivables and Payables Management: AoraBooks streamlines the management of receivables and payables, offering businesses a centralized platform to monitor and settle accounts promptly. This capability is vital for maintaining healthy cash flow and sustaining strong financial health.

Seamless Payments Processing: The software facilitates secure and seamless payment processing, ensuring that financial transactions are executed efficiently. This feature not only enhances customer satisfaction but also reduces the risk of errors in financial transactions.

Comprehensive Expense Tracking: AoraBooks provides businesses with a comprehensive expense tracking system, offering insights into spending patterns and facilitating prudent financial decision-making. Efficient expense management contributes to cost optimization and improved profitability.

Mobile Accessibility for On-the-Go Operations: Recognizing the importance of mobility in the modern business environment, AoraBooks offers a mobile-friendly interface. This allows users to manage inventory and finances on the go, providing unparalleled flexibility in day-to-day operations.

Integrated Point of Sale (POS) System: AoraBooks integrates a Point of Sale system seamlessly, enabling businesses to conduct sales directly within the inventory management system. This simplifies transactions and ensures real-time synchronization of sales data with the overall financial records.

Versatile Multi-Company and Multi-Branch Support: AoraBooks caters to the diverse structures of businesses by offering robust support for multiple companies and branches within a unified platform. This versatility is particularly beneficial for businesses with complex organizational structures.

Precision in Inventory Management: AoraBooks goes beyond standard inventory management, providing real-time visibility into stock levels. This ensures optimal inventory control, preventing stockouts or overstock situations and minimizing the risk of operational disruptions.

Efficient Banking Transactions: AoraBooks facilitates seamless banking transactions and reconciliation, ensuring that financial data is not only accurate but also up-to-date. This feature streamlines financial operations, reducing manual effort and minimizing errors.

Centralized Contacts Management: AoraBooks simplifies contact management by centralizing information about customers, suppliers, and other stakeholders. This streamlined approach enhances communication and relationship management.

Holistic HR Integration: Integrating human resources features within AoraBooks allows businesses to manage employee information efficiently. This not only ensures compliance with HR regulations but also facilitates a unified approach to business management.

Adherence to GST & VAT Regulations: AoraBooks aids businesses in adhering to TAX regulations with built-in features for GST and VAT compliance. This ensures that businesses operate within the bounds of TAX laws, minimizing the risk of penalties and legal complications.

Insights and Reports for Informed Decision-Making: AoraBooks generates in-depth insights and reports, offering businesses a comprehensive view of their financial health. Informed decision-making is empowered by the availability of accurate and timely data.

Global Reach with Multi-Currency Support: Recognizing the global nature of modern business, AoraBooks supports multiple currencies. This feature facilitates international transactions and expands business horizons for companies engaging in global operations.

The Importance of the Accounts System for Business Operations:

The accounts system serves as the nerve center of business operations, influencing every facet of organizational functionality. AoraBooks understands and prioritizes this crucial element, recognizing that a well-structured and efficient accounts system is the key to unlocking operational ease and success for businesses. Here's how:

Financial Control: An advanced accounting system, as provided by AoraBooks, ensures meticulous financial control. It enables businesses to track income and expenses, monitor cash flow, and maintain a clear financial trail for auditing purposes.

Informed Decision-Making: The availability of real-time financial data empowers businesses to make informed decisions. AoraBooks' robust accounting system generates insights and reports, facilitating strategic decision-making based on accurate and up-to-date information.

Regulatory Compliance: Compliance with TAX regulations and financial standards is non-negotiable for businesses. AoraBooks' integrated features for GST and VAT compliance help businesses navigate the complexities of taxation, reducing the risk of penalties and legal complications.

Cash Flow Management: Efficient receivables and payables management, facilitated by AoraBooks, ensures optimal cash flow. This is essential for meeting operational expenses, investing in growth opportunities, and weathering economic uncertainties.

Operational Efficiency: The seamless integration of invoicing, payments, expenses, and banking within AoraBooks contributes to operational efficiency. Businesses can streamline processes, reduce manual effort, and minimize the likelihood of errors, leading to smoother day-to-day operations.

Strategic Planning: AoraBooks' insights and reports feature provides businesses with a panoramic view of their financial landscape. This aids in strategic planning, allowing businesses to identify trends, anticipate challenges, and position themselves for long-term success.

Customer and Vendor Relations: Timely and accurate financial transactions, supported by AoraBooks, contribute to positive customer and vendor relations. Clear and transparent invoicing, efficient payment processing, and organized expense tracking enhance trust and collaboration.

Employee Management: The integration of HR features within AoraBooks ensures that employee information is seamlessly managed. This contributes to efficient payroll processing, compliance with HR regulations, and overall workforce management.

Global Expansion: For businesses with global aspirations, AoraBooks' multi-currency support facilitates international transactions. This feature opens doors to new markets, allowing businesses to expand their reach and engage in cross-border operations with confidence.

The Pivotal Role of AoraBooks in Business Management:

AoraBooks plays a central and transformative role in business management, serving as the linchpin that connects and optimizes various facets of organizational functionality. As businesses navigate the complexities of the modern marketplace, AoraBooks becomes a strategic ally, empowering them with a well-structured and efficient accounts system. Here's how AoraBooks contributes to managing and enhancing business operations:

1. Financial Control:

AoraBooks provides an advanced accounting system that goes beyond basic bookkeeping. It ensures meticulous financial control by allowing businesses to track income and expenses accurately. The platform's capabilities extend to monitoring cash flow, providing a real-time snapshot of the financial health of the business. This granular control is vital for making sound financial decisions and maintaining transparency, especially when facing audits.

2. Informed Decision-Making:

With AoraBooks, businesses gain access to real-time financial data that acts as a powerful tool for informed decision-making. The robust accounting system generates insights and reports, offering a comprehensive view of the company's financial landscape. Armed with accurate and up-to-date information, businesses can make strategic decisions that align with their goals, ensuring a proactive and adaptive approach to market dynamics.

3. Regulatory Compliance:

Navigating the complexities of TAX regulations and financial standards is made more straightforward with AoraBooks. The integrated features for GST and VAT compliance ensure that businesses adhere to regulatory requirements. By automating compliance processes, AoraBooks reduces the risk of errors and mitigates the potential for penalties, providing businesses with the confidence that comes from operating within legal parameters.

4. Cash Flow Management:

Efficient cash flow management is a cornerstone of business sustainability, and AoraBooks excels in this regard. The platform facilitates seamless receivables and payables management, optimizing cash flow by ensuring timely payments and settlements. This financial fluidity is essential for meeting operational expenses, seizing growth opportunities, and weathering economic uncertainties with resilience.

5. Operational Efficiency:

AoraBooks streamlines key operational processes through the seamless integration of invoicing, payments, expenses, and banking functionalities. This integration minimizes manual effort, reduces the likelihood of errors, and contributes to overall operational efficiency. By providing a unified platform for various financial activities, AoraBooks simplifies workflows, allowing businesses to focus on core operations.

6. Strategic Planning:

AoraBooks' insights and reports feature acts as a strategic compass for businesses. The panoramic view of the financial landscape enables companies to engage in proactive strategic planning. By identifying trends, anticipating challenges, and understanding financial performance, businesses can position themselves for long-term success and sustainability in a dynamic market environment.

7. Customer and Vendor Relations:

Timely and accurate financial transactions supported by AoraBooks contribute to positive customer and vendor relations. The platform's capabilities for clear and transparent invoicing, efficient payment processing, and organized expense tracking enhance trust and collaboration. Strong financial management, facilitated by AoraBooks, becomes a cornerstone for building lasting and mutually beneficial relationships with stakeholders.

8. Employee Management:

AoraBooks extends its utility beyond financial management to encompass human resources. The integration of HR features ensures seamless employee information management. From efficient payroll processing to compliance with HR regulations, AoraBooks contributes to effective employee management. This integrated approach fosters a cohesive organizational structure and enhances workforce efficiency.

9. Global Expansion:

For businesses with global aspirations, AoraBooks becomes a catalyst for expansion. The platform's multi-currency support facilitates international transactions, removing barriers to entry into new markets. AoraBooks provides the necessary tools for businesses to operate seamlessly across borders, supporting their global ambitions with confidence.

In essence, AoraBooks is more than a software solution; it is a strategic enabler for businesses seeking not only to manage their operations efficiently but also to thrive and grow in a competitive landscape. By placing emphasis on a well-structured accounts system and integrating a comprehensive set of features, AoraBooks empowers businesses to navigate challenges, capitalize on opportunities, and build a resilient foundation for sustained success.

In conclusion, AoraBooks is not just a software solution; it is a strategic partner for businesses looking to elevate their operational prowess. By recognizing the pivotal role of the accounts system and integrating advanced features, AoraBooks is poised to simplify the complexities of business management. As businesses navigate the intricacies of the modern marketplace, AoraBooks stands ready to be the catalyst for operational ease, financial control, and sustained success.